Given how fast-paced and digitized everything has become, it’s no wonder that paying quickly, easily and securely through phones and computers is now the norm. So, for companies to compete in the marketplace, they also need to offer these types of payment options to their customers. When done well, consumers are happy, companies enjoy more sales as a result of less payment friction… it’s a win-win all-around, right?

Not so fast. This rosy picture of easy consumer transactions on the go and easy payments for businesses is certainly the goal of end-to-end payment solutions, but before it can be the true reality, there are numerous barriers to overcome. One of these, unsurprisingly, is fraud. Specifically, “card not present” (CNP) fraud has been rising and is expected to reach costs of $7.2 billion annually by the end of 2020.

Consumers need to be careful where and how they use their credit cards and businesses need to be watchdogs on their end, to be sure. But how can payment solution providers also protect the welfare of their customers, and their own reputations, in the midst of these financial circumstances? Read on to see if you’re covered when it comes to CNP fraud prevention.

Be Ready to Spot Red Flags

Payment providers are usually on the ball when it comes to knowing security best practices. But there can still be a gap between knowing what you need and actually implementing processes and training your team on the nuances. Your internal team should be trained in all the red flags that could alert them (or your customers) to potential CNP credit card fraud.

For example, they should know to pay close attention to international transactions, abnormal order volumes and special requests (like rush orders, requests to use a payment method your company doesn’t typically support, shipping and billing addresses that match). Train your team and your customers to be on the lookout for these red flags.

Furthermore, as a payment provider, there are plenty of automated solutions that track customer patterns and can alert you when abnormal transactions are taking place. Automated data analysis can be a first line of defense that notifies you of potential issues, at which point a manual review can take place.

Are you Highly Specialized?

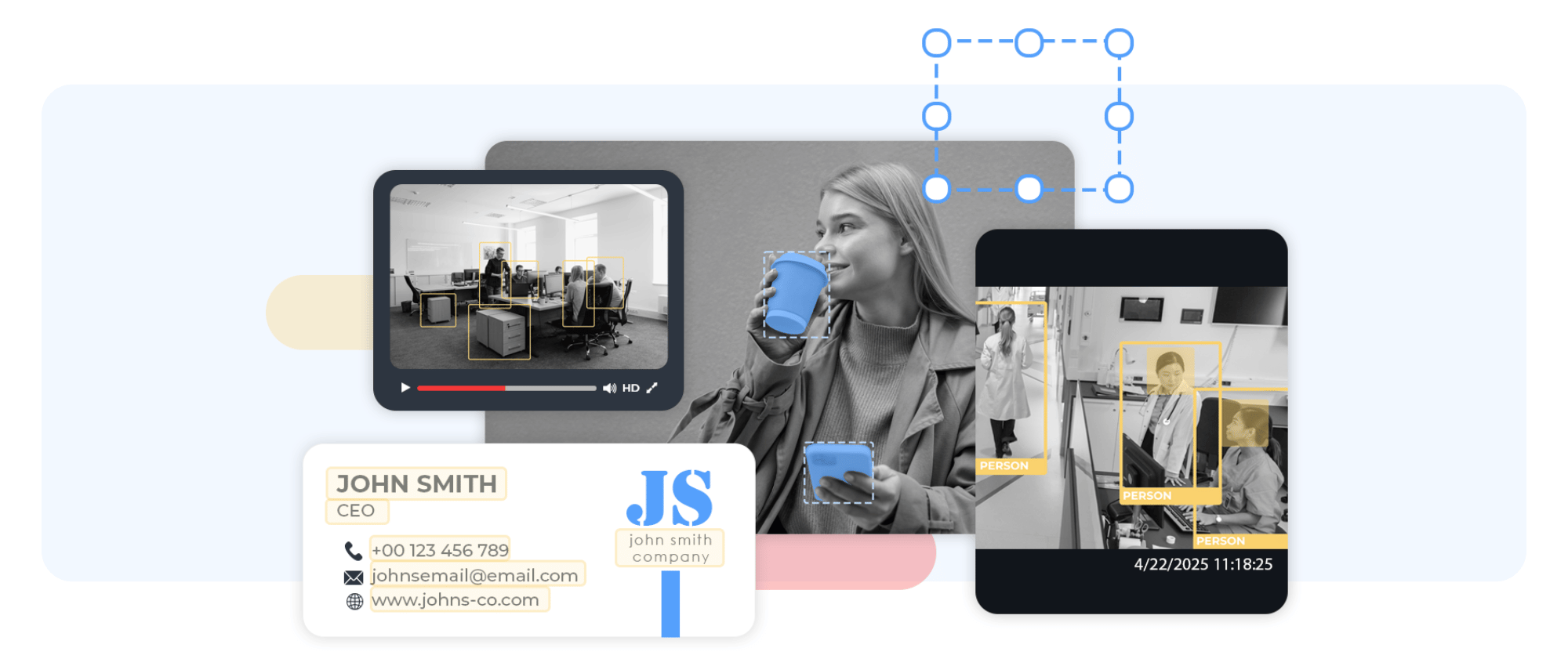

Sometimes, payment solution providers handle their security in-house but increasingly there’s been a shift toward outsourcing. It makes sense since a qualified business process outsourcing (BPO) partner like Conectys has deep expertise in data security and the advanced tech needed to keep you and your customers’ sensitive information safe.

We enable you to provide consumer authentication solutions so your customers are protected with online purchases through your platform. We also created (and equip you to use) our own in-house, cloud-based customer service platform ConectysOS, complete with PCI DSS compliant API integration. This means you can make payments securely through payment solutions providers and CRMs, digitally and over the phone.

Furthermore, we’re specialized with tokenization and end-to-end encryption technologies that strengthen your own security measures and ensure that the data flowing through your platform won’t be compromised.

Security and UX can’t be mutually exclusive

Even if you feel comfortable handling your data security internally, it’s important to remember there should never be a tradeoff between security and user experience (UX). You want your customers to be able to make payments quickly and easily through your service, all the while maintaining peace of mind.

In order to achieve this, you need to work with a BPO partner that understands all angles of the customer experience and this complex level of technology. Conectys is certified PCI DSS compliant and ISO 9001:2018 certified. We constantly work to meet and exceed data protection requirements, as well as offering our customers the tools needed to keep customer friction low (or ideally nonexistent).

If you’d like to learn more about eliminating CNP fraud and upgrading your data security while not sacrificing your customer experience, please contact us.